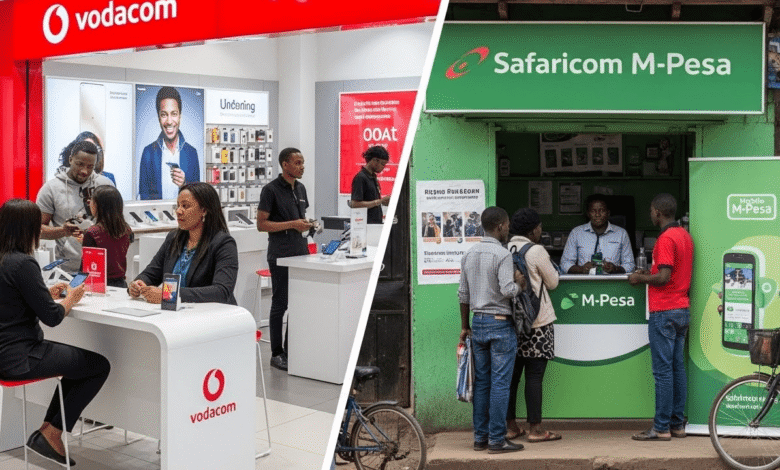

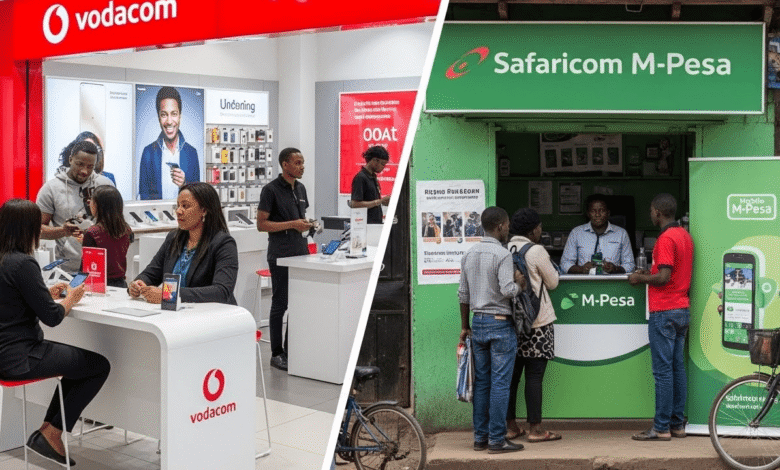

Vodafone is set to acquire the Government of Kenya’s 15% stake in Safaricom for KSh 204.3 billion, plus an upfront dividend of KSh 40.2 billion, bringing the total transaction to KSh 244.5 billion. Post-sale, the shareholding structure will be: Vodafone 55%, GoK 20%, Public 25%.

Below , kindly find President’s SOTN Remarks on the planned acquisition of Safaricom by Vodafone

Vodafone x Treasury Stake Sale:

Question &Answer

Question : What happened?

Answer : Vodafone is set to acquire the Government of Kenya’s (GoK) 15% stake in Safaricom for KSh 204.3 billion, along with an early dividend payout of KSh 40.2 billion, bringing the total transaction value to KSh 244.5 billion.

Once ratified, the shareholding structure will be:

- Vodafone – 55%

- Government of Kenya – 20%

- Public – 25%

Question : Is this a good deal?

A: Yes. The deal helps Kenya meet national obligations without raising taxes or borrowing, supported in five key ways:

- Premium Price: Vodafone paid KSh 34 per share, 23.6% above recent market prices.

- Strategic Partnership: Vodafone brings expertise, capital, and technological leadership.

- Strong Fiscal Outcome: GoK retains 20% stake and ongoing dividends while funding development projects.

- Upfront Dividend Compensation: Vodafone pays KSh 40.2 billion upfront for future dividends.

- Seed Capital for National Funds: Proceeds fund the National Infrastructure Fund and Sovereign Wealth Fund for long-term projects.

Question: Why didn’t GoK sell to Kenyans?

Answer: Four reasons:

- Vodafone offered a premium price and block-sale convenience.

- A KSh 100 billion KPC IPO is underway, making simultaneous sales difficult.

- Proceeds in US dollars strengthen foreign reserves.

- A strategic, experienced partner accelerates innovation and global competitiveness.

Question: Doesn’t selling a critical telecom asset pose a national security risk?

Answer : No. Reasons include:

- It’s a shareholder adjustment, not a takeover; GoK retains 20%.

- Nine conditionalities safeguard Kenyan interests, including:

- No employee layoffs

- Continuation of CSR initiatives

- Board Chair and CEO must be Kenyan

- Majority of trustees and independent directors remain Kenyan

- Vodafone is an established partner since 2000, providing technical and operational support.

Question : Is this just “eating tomorrow’s lunch today”?

Answer: No. Proceeds feed the National Investment Fund (NIF) worth KSh 150 billion, leveraging private capital to unlock up to KSh 1.5 trillion for infrastructure and development off-budget, ensuring sustainable growth.

Question: Why not sell loss-making state enterprises instead?

Answer: Loss-making entities are not commercially attractive. Safaricom is a mature, high-value asset, making it a pragmatic choice to reduce fiscal pressure while funding productive investments.

Question: Was the stake underpriced?

Answer: No. The shares are sold at market value, not speculative future worth. Selling a portion of the company is priced for today’s market, not potential future growth.

Question : Is this just “eating tomorrow’s lunch today”?

Answer: No. Proceeds feed the National Investment Fund (NIF) worth KSh 150 billion, leveraging private capital to unlock up to KSh 1.5 trillion for infrastructure and development off-budget, ensuring sustainable growth.

Question: Why not sell loss-making state enterprises instead?

Answer: Loss-making entities are not commercially attractive. Safaricom is a mature, high-value asset, making it a pragmatic choice to reduce fiscal pressure while funding productive investments.

Question: Was the stake underpriced?

Answer: No. The shares are sold at market value, not speculative future worth. Selling a portion of the company is priced for today’s market, not potential future growth.

Question : Is this just “eating tomorrow’s lunch today”?

Answer: No. Proceeds feed the National Investment Fund (NIF) worth KSh 150 billion, leveraging private capital to unlock up to KSh 1.5 trillion for infrastructure and development off-budget, ensuring sustainable growth.

Question: Why not sell loss-making state enterprises instead?

Answer: Loss-making entities are not commercially attractive. Safaricom is a mature, high-value asset, making it a pragmatic choice to reduce fiscal pressure while funding productive investments.

Question: Was the stake underpriced?

Answer: No. The shares are sold at market value, not speculative future worth. Selling a portion of the company is priced for today’s market, not potential future growth.