The National Treasury wishes to notify the public of the Government’s proposal to undertake a partial divestment of its shareholding in Safaricom Plc.

This proposal is being advanced within the framework of the Public Finance Management Act (PFMA) and all relevant laws governing the management and disposal of shares in government-linked corporations (GLCs).

In accordance with the legal requirements governing State investments, the proposed divestment will undergo the full sequence of statutory and regulatory review.

The process includes submission to Cabinet for consideration, after which the proposal will be presented to Parliament as required under the Public Finance Management Act and relevant constitutional provisions governing changes to national investments.

The partial divestiture generates approximately KES240.5bn in aggregate proceeds.

This is yet another purposeful step in the Government’s vision to allocate resources into critical infrastructure investment priorities, specifically Energy, Roads, Water, Airports etc.

The transaction will also be subject to the review and approval of the appropriate regulators, including the Capital Markets Authority, the Central Bank of Kenya, the Communications Authority of Kenya, and the Competition Authority of Kenya, consistent with the mandates each institution holds over capital markets, financial stability, telecommunications infrastructure, and competition policy.

As required by law, the process will also incorporate the necessary disclosure, transparency, and public participation components to ensure that the divestment is conducted in a manner that protects the public interest and upholds the highest standards of accountability.

Once the transaction is complete, the State will continue to retain a significant strategic stake in the company and will remain an active participant in its long-term development.

All national safeguards, including data protection, cybersecurity, critical digital infrastructure, spectrum allocation, and the integrity of national payment systems, remain firmly safeguarded under the Kenyan regulatory environment.

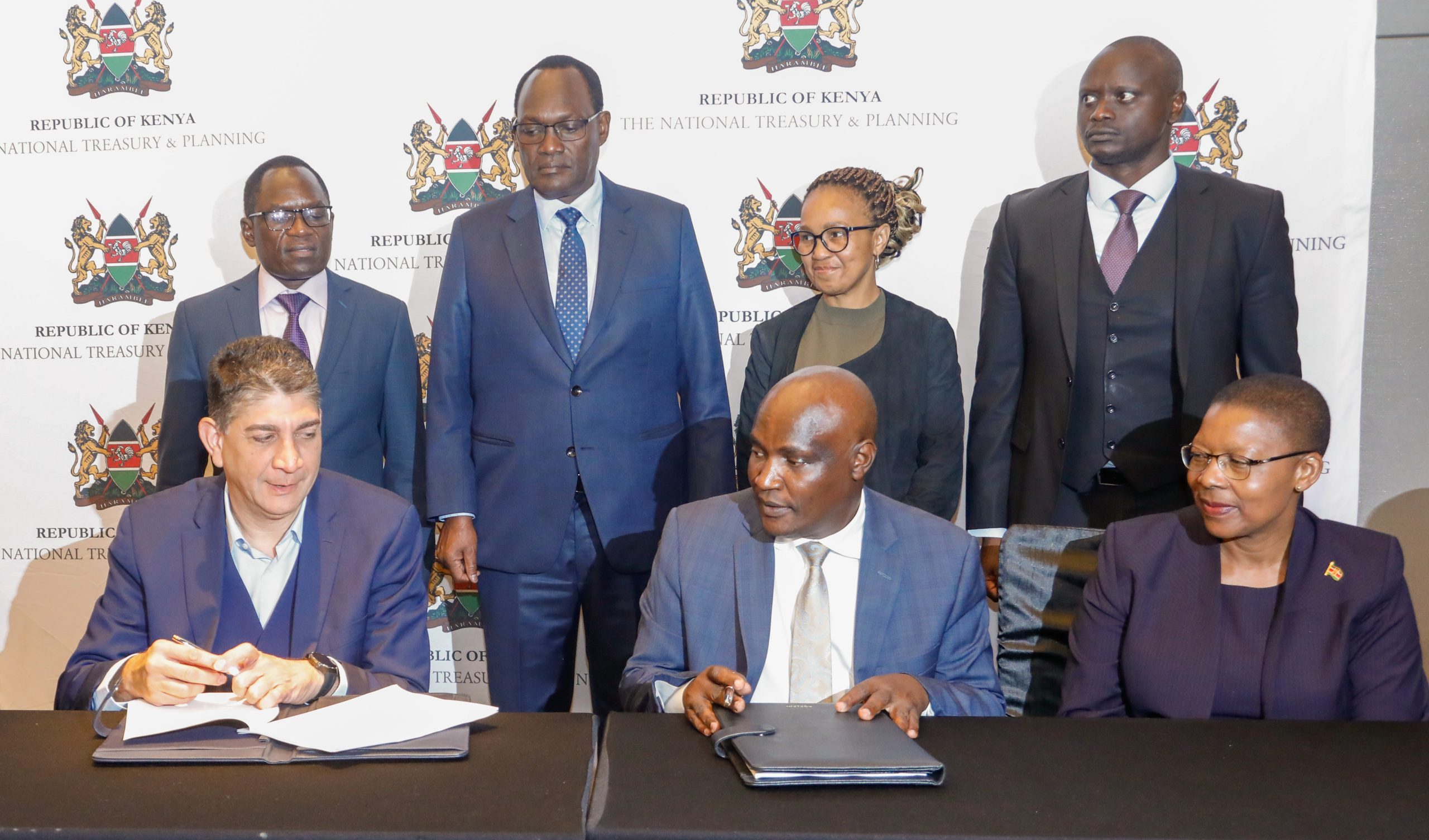

Commenting on the proposal, the Cabinet Secretary for the National Treasury, FCPA John Mbadi, stated:

“The Government remains firmly committed to prudent fiscal management and sustainable economic growth.

This proposed partial divestment is guided by the need to mobilise non-tax revenue in a responsible and forward-looking manner, reducing pressure on taxpayers and limiting our reliance on debt to finance national priorities.

The proceeds will form part of the seed capital for the National Infrastructure Fund and the Sovereign Wealth Fund, helping us build the long-term financial foundations our country needs.

This aligns with the vision articulated by H.E. President William Ruto: a Kenya that is less dependent on debt and less reliant on increasing taxes to fund development. It is a good and timely move for our nation.”

Vodacom Group has reaffirmed its position as a long-term investor committed to supporting Safaricom’s continued growth, innovation, and regional expansion. Vodacom Group CEO, Shameel Joosub, said:

“Vodacom welcomes this development and remains fully committed to Safaricom’s long-term growth and success. Our partnership with Kenya spans over two decades, and we continue to view Safaricom as a strategically important business with strong fundamentals and significant potential. We will remain responsible, long-term investors and partners in advancing Kenya’s digital and financial inclusion ambitions.”

Commenting on the proposed divestment, Safaricom Group CEO, Peter Ndegwa, said:

“We appreciate the Government’s continued confidence in Safaricom and its recognition of the role we play in Kenya’s digital and economic transformation. Safaricom’s operations, leadership, and strategic direction remain strong, and we continue to focus on delivering innovative products and services that uplift our customers and support Kenya’s digital ambition.”

Further details will be communicated following the completion of Cabinet, Parliamentary, and regulatory review processes.