Kenya’s real estate market is booming, attracting investors from all over the country and abroad. But with opportunity comes risk.

From fake title deeds to unresolved succession issues, buying property in Kenya without proper legal checks can lead to costly mistakes.

Clement Waweru ,CEO of Cledun Realtors Limited, emphasizes that legal due diligence is not optional—it’s essential. “Verifying ownership, checking for encumbrances, and ensuring all government approvals are in place is the only way to safeguard your investment,” he says.

Before making any payment, buyers should confirm the title deed, verify the seller’s identity, check land rates and rent clearance, and review survey maps to ensure boundaries are correct. Visiting the site in person is crucial to confirm the property exists, isn’t occupied illegally, and has proper access to services.

It’s also important to ensure planning and zoning approvals are in place, especially for developed plots or those intended for construction.

A qualified lawyer should draft or review the sale agreement, and buyers should confirm there are no disputes or inheritance claims affecting the property.

For land sold by companies, Waweru advises checking corporate registration, board resolutions authorizing the sale, and compliance with tax obligations. Skipping these steps is a fast track to legal headaches and financial loss.

Legal documents every buyer should have include the title deed, national ID or company documents, KRA PIN, clearance certificates, survey maps, approved building plans, and a properly drafted sale agreement.

Additional government consents may be required for agricultural land, while taxes such as stamp duty and capital gains tax must be accounted for.

Red flags like sellers refusing to share the original title, mismatched survey maps, pressure for cash payments, or disputes over the land should never be ignored. Once all checks are completed, buyers can execute the land transfer, pay applicable fees, and collect the title deed in their name.

Waweru concludes: “Kenya’s property market offers incredible potential, but thorough legal checks are the key to protecting your investment. Engage a lawyer, do your due diligence, and insist on proper documentation—you’ll invest with confidence.”

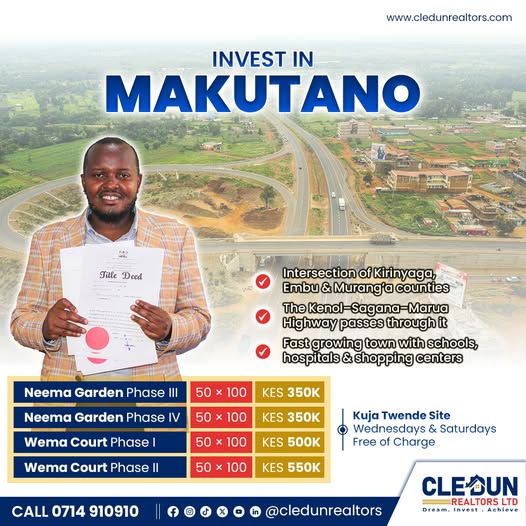

AVAILABLE PROJECTS:

✨ Neema IV, Makutano @KES 350K

✨ Wema I, Makutano @KES 499K

✨ Wema II, Makutano @KES 599K

✨ Bahari Palms Residence, Malindi @KES 800

✨ Treasure Park II, Rumuruti @KES 199K

✨ Furaha Garden I, Rumuruti @KES 99K

📞 +254 714 910910